What does a Capital Structure of a Company really mean?

As an investor understanding a company's capital structure is essential when evaluating its financial health and growth potential. A company's capital structure represents the way in which it finances its operations, investments, and growth initiatives, and this mix of debt and equity can significantly impact its risk profile, future growth potential, and overall financial stability. In this article, we will look into the concept of capital structure, discussing the differences between equity financing and debt financing, how companies raise funds, and how they distribute excess cash. We will also examine what is the debt-to-equity ratio and explore how the capital structure varies across different industries. By the end of this article, you will have a better understanding of what a company's capital structure is and how it can impact a company's risk profile, future growth potential, and overall financial stability.

Two important questions all investors must ask themselves when researching a company are:

How much financing does the company need to aid its core business plans?

What combination of debt and equity is used to finance the business?

What these questions are asking is in fact what is the capital structure of the company?

But what is capital structure?

In simple terms, capital structure is the mix of debt and equity a company has. Equity is the money put by shareholders into the company, this means no interest needs to be paid on this amount of money. In contrast, debt is the money received from debtholders, banks, etc. in this case interest must be paid on the amount of money received. It is very difficult to determine the best capital structure, for this reason, companies focus on finding effective ways to finance their specific needs.

Equity Financing vs. Debt Financing

The capital structure of a company typically includes a combination of debt and equity financing. Debt financing refers to borrowing money from external sources such as banks, bondholders, and other lenders. Debt financing involves an obligation to repay the borrowed amount plus interest over a period of time.

Equity financing, on the other hand, refers to raising funds by selling ownership in the company to investors, such as shareholders, who then become part owners of the company. Equity financing involves no obligation to repay the invested amount, but the investors receive a share of the profits and may also have voting rights on company matters.

Impact of capital structure on a company's credit rating?

The capital structure of a company can have a significant impact on the company's financial performance and risk profile. Companies with a high level of debt financing have a higher risk of default and bankruptcy but may also have a lower cost of capital as debt is usually cheaper than equity financing. Companies with a high level of equity financing have a lower risk of default and bankruptcy but may also have a higher cost of capital due to the need to offer higher returns to attract investors.

The capital structure of a company also has a strong impact on its credit rating. This in turn has an impact on the company's access to debt markets as well as how high or low will the interest payments on the company's debt will be.

You can learn more about credit ratings from our previous article on the matter!

How do Companies Raise Funds or Cut Cash Outflows?

From a cost-of-transaction perspective, the issuance of equity is more effective when the company is issuing a large amount of equity. This decision usually leads to a short-term price reaction in the stock market, but it does not affect the company’s intrinsic value.

In principle increasing leverage and returning cash to investors typically meets with positive market reactions, while decreasing leverage and asking investors for more capital typically leads to negative price reactions.

For example, cutting dividends not only provides a signal of lower future cash flows but also decreases leverage, thereby reducing tax shields on interest. The company is in fact reducing cash outflow by cutting dividends, but it is also missing on tax shields. By reducing cash outflows, cutting dividends gives management more slack on investments.

Examples of raising funds or cutting cash outflows:

Cutting dividends: The stock market typically interprets such reduction as a signal of lower future cash flows.

Issuing Equity: Typically share price declines on the announcement of issuing of equity. This is because investors assume that managers have superior insights into the company's true business value and financial outlook. Investors typically believe a company will only issue equity if the shares are overvalued by the stock market or if the company needs additional funds. Therefore, the share price will decrease in the short term, even if the share price is not overvalued.

Issuing Debt: There is ample evidence that investors interpret the issuance of new debt much more positively than equity offerings. Investors see the issuance of debt as a strong signal that future cash flows will be sufficient. Investors also know that management issues debt when they perceive a company’s share price to be undervalued.

How Companies Redeem Excess Funds:

Dividend Increases: Companies that increase their dividends generally receive a positive market reaction on the day of the announcement. While for companies that propose dividend payments for the first time, the impact is even greater. This is because companies that start paying dividends typically experience higher rates of earnings growth. Investors understand that managers are very confident that future cash flows from operations will be sufficient to pay for capital expenditures as well as dividends.

Share repurchases: This is another way of distributing cash to investors. Investors typically interpret share repurchases as a positive signal due to:

i) Share buybacks indicated to investors that management believes shares are undervalued. (If shares were overvalued management would probably pay down debt)

ii) Share buybacks show management is confident about future cash flows and that they will be strong enough to support future investments and debt commitments.

iii) It shows that the company will not use its excess cash on value-destroying investments.

iv) Share buybacks can result in lower taxes for investors in some jurisdictions.

Fact: Share buybacks and dividend payments do not create intrinsic value.

Research shows that when a company announces a small program of share buybacks of 10% or less of total shares, shares increase in value by around 2 to 3%. However, when companies announce a bigger program of more than 15% then the share can increase in value by around 15%.

Finally, share buybacks give the investor the option of either keeping the stock and owning more of the company’s value or if the investor wants to cash in, the investor can sell the stock.

Debt repayment: With this option, if the company does not need to recover from financial distress, this typically is not seen as a positive in the stock market.

i) Buying back bonds is more likely to indicate to investors that management believes the stock is overvalued.

ii) It signals future cash flows may not be sufficient to cover future debt repayments, therefore management is reducing the corporate debt burden.

iii) Debt repayment can be a strong signal of no investment opportunities while signaling stock is overvalued.

Fact: One of the only situations where paying the debt will be seen as a positive by the stock market is when a company is in financial distress. This in fact shows the company is on a recovery path and is well-seen by the market.

Debt to Equity Ratio Explained

The debt-to-equity ratio is a financial metric that measures a company's financial leverage by comparing its total debt to its total equity.

The debt-to-equity ratio is used to assess a company's financial stability and its ability to meet its financial obligations. A high debt-to-equity ratio indicates that a company has a significant amount of debt relative to its equity, which can be an indication of financial risk. A low debt-to-equity ratio, on the other hand, indicates that a company has more equity than debt, which can be an indication of financial stability.

A high debt-to-equity ratio can be concerning for investors because it suggests that the company may have difficulty paying off its debts if it experiences financial difficulty or a downturn in the market. This can lead to a lower credit rating and higher borrowing costs for the company.

In contrast, a low debt-to-equity ratio indicates that the company has a strong financial position, as it has a higher proportion of equity relative to debt. This can be an indication of financial stability and lower risk for investors.

In general, the optimal debt-to-equity ratio will vary depending on the industry and the specific circumstances of the company.

Comparing Capital Structure in Different Industries

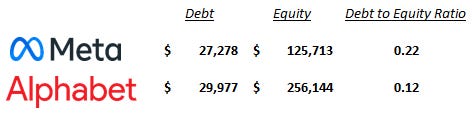

Technology Industry

Technology companies, such as Meta Platforms and Alphabet, typically have a capital structure that is weighted towards equity financing, with a relatively low level of debt financing. These companies tend to have high growth prospects and generate significant cash flows, which allows them to raise funds from equity investors rather than take on debt.

Retail Industry

Retail companies, such as Walmart and Costco, tend to have a capital structure that is weighted towards equity financing, with a relatively lower level of debt financing. These companies have stable cash flows and steady growth prospects, which allows them to take on somewhat higher levels of debt at lower interest rates to finance their operations and expansion.

Energy Industry

Energy companies, such as Occidental Petroleum and BP PLC, tend to have a capital structure that is balanced between debt and equity financing. These companies require significant capital expenditures to explore and develop oil and gas reserves, which requires a mix of debt and equity financing.

Pharmaceutical Industry

Pharmaceutical companies, such as Pfizer and Johnson & Johnson, tend to have a capital structure that is weighted towards equity financing, with a relatively low level of debt financing. These companies require significant amounts of capital to fund research and development activities, and they generate significant cash flows from the sale of their products.

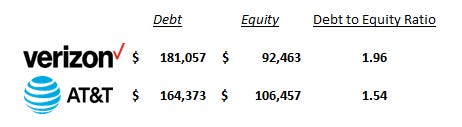

Telecommunications Industry

Telecommunications companies require significant initial capital investment in infrastructure to provide their services. As a result, these companies often have a capital structure that is weighted toward debt financing. For example, companies such as Verizon Communications Inc. and AT&T Inc. have a capital structure that is weighted more towards debt financing, with a smaller proportion of equity financing.

In summary, the capital structure of a company varies significantly based on industry, size, stage of growth, and financial health. While some industries may have a greater reliance on debt financing, others may have a greater reliance on equity financing. The optimal capital structure of a company will depend on a number of factors, including its financial goals and risk appetite. Ultimately, the capital structure should be designed in a way that maximizes shareholder value while minimizing risk.

Disclaimer

The information provided in this article is for informational and educational purposes only and should not be construed as financial or investment advice. The content of this article is based on the authors' personal opinions and research, and it may not be appropriate for your specific investment goals, financial situation, or risk tolerance. Any investment decision you make should be based on your own research and analysis, and you should consult with a qualified financial advisor before making any investment decisions. The author of this article assumes no responsibility or liability for any investment losses or damages that may result from your reliance on the information provided herein.