Understanding Leverage

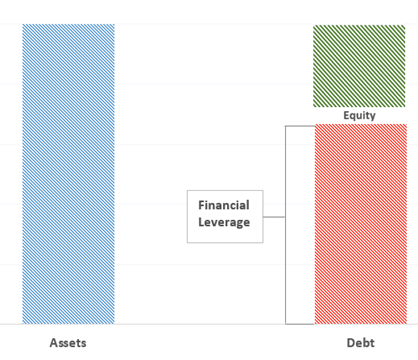

Leverage is the use of debt by a company to acquire assets needed for its operations or to fund the growth of the business by investing in new projects, new technologies, acquiring other companies, etc.

It is important to understand leverage as it will give you a better idea of how much money a company has borrowed and what financial obligations arising from the borrowed money.

Pros of Leverage:

Access to More Opportunities: Leverage can allow companies to access investment opportunities that they might not otherwise be able to afford. This can be particularly useful for small companies which want to participate in larger investments.

Flexibility: Leverage can be used in a variety of ways, giving companies more flexibility in their investment strategies and allowing them to undertake new projects and acquisitions. For example, companies can use leverage to increase exposure to certain markets by making investments or acquiring other companies.

Improved Liquidity: Leverage can increase a company's liquidity by providing additional funds that can be used for investment purposes or for other financial needs.

Tax Benefits: Financial leverage allows companies to deduct interest expenses from their taxable income, which reduces their overall tax liability.

Increased Return on Equity (ROE): By using debt financing, a company can increase its ROE as it can generate more earnings with the same amount of equity.

Lower Cost of Capital: Debt financing is typically cheaper than equity financing, especially for well-established companies with a good credit rating. This is especially true for companies with an investment grade rating.

Faster Growth: Debt financing allows companies to grow faster by providing them with the capital needed to expand operations or enter new markets.

Leverage can deliver key benefits for example in the form of a reduction in taxes. This is because debt is tax deductible. Additionally, it helps management to stay away from overinvestment, as if the company is dealing with debt, it must be MORE DISCIPLINED! Imposing discipline on management is important for low-growth companies as the cost of overinvesting is likely to be high.

Cons of Leverage:

Increased Risk: Leverage amplifies both gains and losses. If an investment performs poorly, the company can lose more money than it would have without leverage.

Interest Costs (Payments): When a company uses leverage, it borrows money to finance its operations. This means the company must pay interest on the debt, which can be a significant expense and reduce profits.

Exposure to Credit rating downgrade: A company that takes on too much debt may see its credit rating downgraded, which can increase the cost of borrowing and reduce access to credit.

Limited financial flexibility: A company that has a lot of debt may have limited financial flexibility. It may not be able to invest in new opportunities or respond to changing market conditions as quickly as a company with less debt.

Reduced profitability: As a company takes on more debt, its profitability may suffer due to the interest payments required. This can limit the company's ability to grow and reinvest in the business.

Dependence on lenders: A company that relies heavily on debt financing may become overly dependent on its lenders. This can limit the company's ability to negotiate favorable terms for future borrowing.

Highly leveraged companies are more likely to forgo investment opportunities or reduce budgets in different areas of the business such as: Research and Development, Marketing, etc. This happens because as companies have financial obligations to pay they need to preserve their cash, with this cash they are available to pay interest and debt repayments coming due.

It should be noted that there is an optimal leverage point for every company where it captures additional tax savings from interest payments and gains value from management's improved discipline. Yet, it is difficult to reach this point because all companies are different.

What to be aware of when looking at companies with leverage:

Leverage should be lower for companies with lower returns, meaning lower profit margins. For these companies, the tax savings potential is smaller because taxable profit is low, and it will continue to be at least for the foreseeable future. Remember taxes paid are taken from profit after all other expenses have been deducted. Additionally, companies with low cash flow generation should not become too leveraged as the financial obligations from debt would drain their cash resources.

Companies with more volatile earnings and higher advertising and research & development costs tend to be financed with less debt. When an investor is interested in a company that is leveraged, there should be an analysis done between earnings volatility, capital expenditures, advertising expenses, research & development costs, etc. By doing this analysis an investor can get a better understanding of the leverage level that is sustainable or if the company may face financial troubles in the future.

Which companies can be the most leveraged?

The most highly leveraged industries are typically mature and asset-intensive (Telecommunications, cement, steel, etc.). Companies with extensive tangible assets are usually able to sustain greater debt levels because they have more assets that can be put as collateral.

Companies producing a strong cash flow generation are among the most highly leveraged, this is because lenders know these companies have little trouble paying the financial obligations (interests) arising from the debt.

Leverage in the Real World

Now that readers have a better understanding of what is leverage and its pros and cons, we will analyze a couple of companies that had debt problems (i.e. too much leverage) and had to take measures in order to prevent default on their financial obligations. The following real-world examples will give you an idea of how debt levels impact the business operations of a company and its shareholders. Additionally, we will explain what measures these companies had to take to preserve cash, reduce debt levels, and what this meant to the companies’ operations and their shareholders. Please note that we will not get into much detail about other factors (problems) as we will try to focus on the debt part.

Who is the company?

The Kraft Heinz Company (“KHC”) is the third-largest food and beverage company in North America and the fifth-largest in the world, with annual sales of $26.5bn. The company holds an array of brands that are well-known worldwide. These include Kraft, Heinz, Oscar Mayer, Philadelphia Cream Cheese, Maxwell Coffee, etc.

How was the debt problem created?

The company's debt problem started in 2015 right after Kraft Foods and Heinz merged into a single company creating the Kraft Heinz Company. In essence, when both companies merged, they created the third-largest food and beverage company in North America and the fifth-largest in the world, however, they also created a company with a mountain of debt.

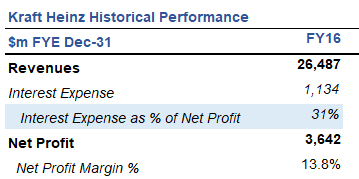

To put it into perspective the newly created company generated $26.3 billion in yearly sales in 2016 while its debt amounted to more than $30 billion. That’s not the whole story, the financial obligations arising from its debt amounted to $1.1 billion in interest payments on a yearly basis. This is exactly what leverage does, it takes away financial flexibility while the profits of the company were being depressed by more than one billion Dollars on a yearly basis.

Going deeper into the problem:

One could think that $1.1 billion in interest payments for a company that generates $26.3 billion is not a deal breaker, however, there were other expenses the company needed to pay including: Cost of Goods Sold of ~$17.2 billion per year, Selling, General, and Administrative Expenses of $3.5 billion, Capital Expenditures of $1.2 billion, dividend payments of $3.6 billion, etc.

Looking at the bigger picture there was a problem as the cash coming into the company did not cover the cash going out of the company. All these expenses were not sustainable, and the company had to take action to reduce them.

Actions taken by the Kraft Heinz Company:

As management was using the company’s cash reserves to keep up with expenses, management decided to cut dividends from $62.5 cents per share on a quarterly basis to $40 cents per share. This in fact was a 36% reduction in dividend payments and as a result, the company reduced its yearly dividend payments to $1.9 billion compared to the $3.2 billion paid during the previous years.

In addition to the dividend cuts, management had to find ways to reduce the debt as fast as possible. The way to do this was by selling assets, KHC started by selling assets in India for $625 million but this was clearly not enough. So, in late 2020 the company agreed to sell its natural cheese business to Groupe Lactalis for a purchase price of $3.2 billion. Furthermore, KHC also agreed to sell its nuts business (including Planters), to Hormel Foods for $3.4 billion. In total KHC sold about $7.3 billion worth of assets in order to deleverage the company. But how did this impact the shareholders?

Looking at the Debt Problem as a Shareholder:

Let’s imagine you were a shareholder of KHC since its merger, being the savvy investor you are, you know that one of the easiest expenses to cut for a company without hurting its operations are its dividends. Yes, the shareholders (you) will be extremely angry when this happens. However, as management wants to protect the business operations, it will take this exact measure. There are a couple of things to understand here. When a company cuts dividends its share price decreases significantly. This is because investors are no longer receiving the income they set out to receive when they made the initial investment. This usually causes the most powerful shareholders to start asking for management changes. Remember these investors are not only losing value through the share price decrease but they are also losing a percentage of the income they were receiving on a quarterly basis.

Additionally, as the company sold its assets, its size was significantly reduced. For example, after KHC sold its assets, it lost about $2.9 billion in revenues, its balance sheet shrank as those assets were no longer a part of the company, and the cash flows generated were also reduced. Once investors realized this, they started selling their shares, and the stock price eventually plummeted by more than 75% from its all-time highs.

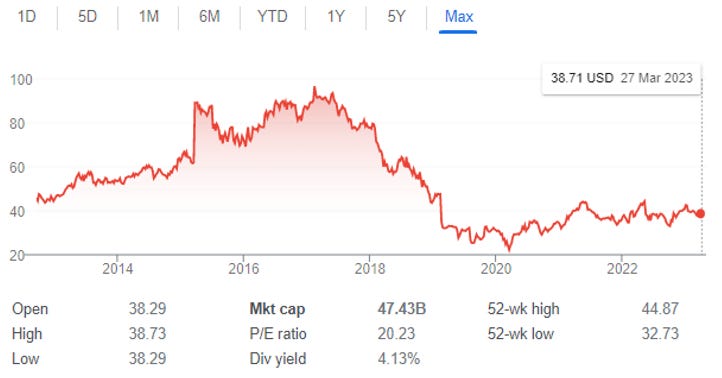

From the chart above you can see the share price evolution of KHC. As can be seen, right in the middle of 2017 one share from KHC was valued at close to $100. Due to the dividend cuts, asset sales, etc., the company’s share price plummeted from close to $100 in 2017 to $22 in March of 2020. As a shareholder, you would have lost a significant percentage of the fixed income (dividend payments) coming from owning the shares, as well as a decrease in the total worth of the shares (around 75%).

Let’s now look at how JDE Peet’s faced similar problems with debt but used its robust cash flow from operations, IPO, and credit facilities to repay debt at a fast pace.

Who is the company?

JDE Peet's NV (“JDE”) is the world's leading pure-play coffee & tea company. The company serves customers and consumers with coffee & tea in more than 100 markets through a portfolio of over 50 brands, including L'OR, Peet's, Jacobs, Senseo, Tassimo, Douwe Egberts, etc. JDE Peet's is a well ran company with an outstanding management team and a dominant position in a stable industry.

How was the debt problem created?

In 2012, JAB Holding purchased Peet's Coffee for approximately $1 billion, followed by the acquisition of Douwe Egberts for ten times that amount in 2013. Over the years, JAB expanded the global presence of both companies until 2019, when it decided to merge them to create the world's largest pure-play coffee and tea company. JDE Peet's subsequently went public in 2020, raising €2.25 billion through its IPO and using a large portion of the proceeds to repay debts.

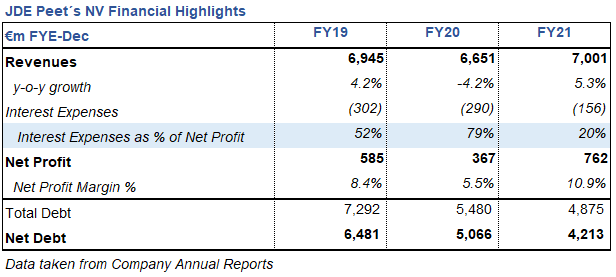

At the time of the IPO, JDE Peet's was highly leveraged, and the management team set out to deleverage the company as quickly as possible. For reference, in 2019, the company's debt position totaled €7.3 billion, while revenues generated stood at €6.9 billion. Interest expenses significantly impacted the company's net profits for the first couple of years, accounting for more than 50% of the total net profits.

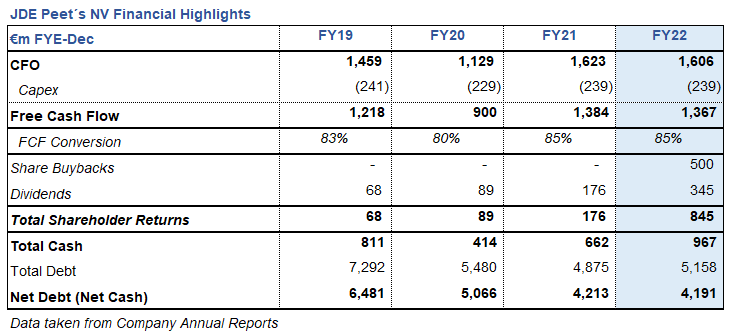

As it can be seen from the table above, due to the company’s highly leveraged position, interest expenses were depressing profits significantly. This problem was only solved after a couple of years of repaying debt. How did JDE Peet's manage to do this?

Actions taken by JDE Peet's:

To achieve its goal of deleveraging the company, JDE Peet's management team strategically utilized various financial instruments, including term loans, supply chain finance facilities, revolving credit facilities, and the issuance of bonds in the capital markets. This financial support system allowed the management team to optimize the company's capital structure while mitigating the impact of its highly leveraged position. Furthermore, management decided to withhold most of its free cash flow to have liquidity and pay the necessary debt repayments in a timely manner.

From the table above one can grasp that most of the free cash flow was not going toward dividends, share buybacks, or even towards cash. However, we can see that the debt levels decreased significantly during 2019 and 2021, meaning the company was using most of its free cash flow to repay debt. Once debt levels were decreased, we can see that shareholder returns start increasing. Essentially, once debt decreased by approx $2.2 billion, shareholder returns ballooned to $845 million as the company was able to retain a larger portion of its free cash flow.

What can we conclude from these Leverage examples?

As an investor every time you want to invest in a company that has a significant amount of debt, you need to understand if the company will be able to keep making the necessary investments to remain financially and operationally healthy, keep its dividend pay-out policy, etc. It is important to understand that having a significant amount of debt does not necessarily mean the company will need to take action to reduce its financial obligations before they come due. If a company can sustain its debt levels and continue its operations, then there is no problem. The problem arises when a company starts having trouble meeting these obligations, it is then when it must take actions to reduce them or at least be able to meet them. The actions which need to be taken usually impact the operations, management, and shareholders of the company (as can be seen from the Kraft Heinz example).

Disclaimer

The information provided in this article is for informational and educational purposes only and should not be construed as financial or investment advice. The content of this article is based on the authors' personal opinions and research, and it may not be appropriate for your specific investment goals, financial situation, or risk tolerance. Any investment decision you make should be based on your own research and analysis, and you should consult with a qualified financial advisor before making any investment decisions. The author of this article assumes no responsibility or liability for any investment losses or damages that may result from your reliance on the information provided herein.