Kraft Heinz: The Awakening of a Sleeping Giant

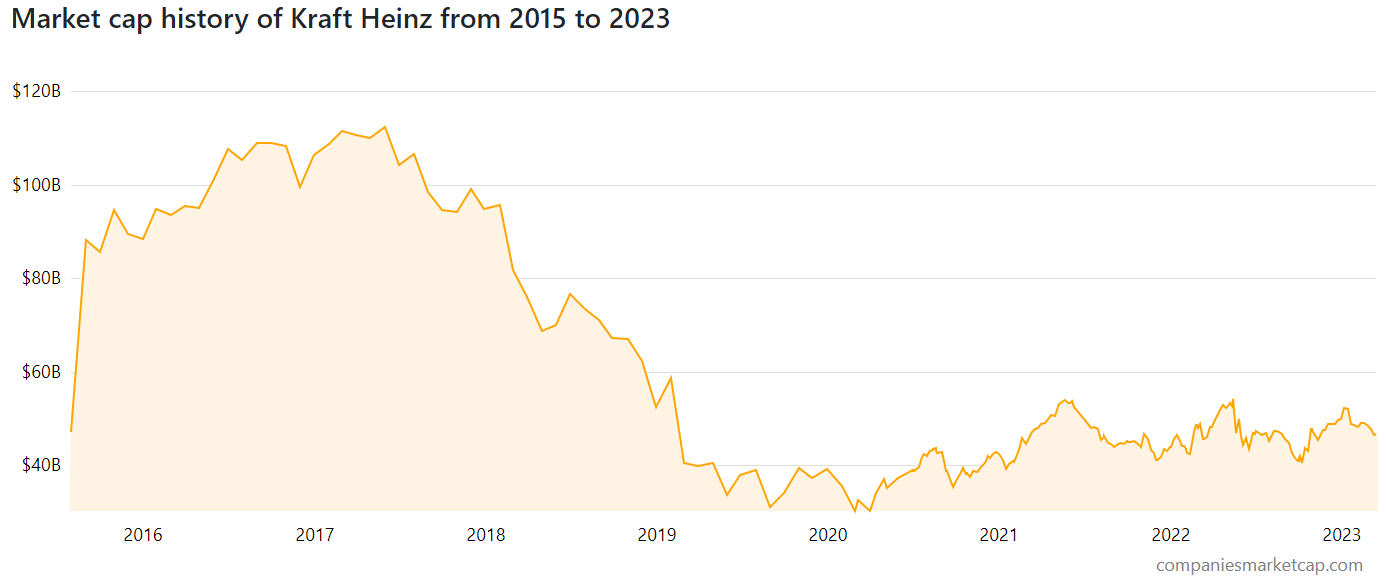

The Kraft Heinz Company (“KHC” or “The Company”) is one of the largest food and beverage companies in the world, with a portfolio of brands that includes Kraft, Heinz, Oscar Mayer, Philadelphia, etc. The company was formed in 2015 through the merger of Kraft Foods Group and H.J. Heinz Company. Since its merger, the company was battered down by numerous challenges, including declining sales, stagnant brands, significant asset write-downs, unsustainable debt levels, the loss of its investment grade rating, changes in management, and slashing of dividends, among others. These events led to the decline of its market valuation, with the company losing more than 70% of its value from its all-time highs.

However, during the past three years, the company has taken the necessary steps to transform its business, reduce its debt burden and adapt to changing consumer preferences. In this article, we will take a deep dive into the Kraft Heinz Company, its recent history, its restructuring process, its current financial position, and its new strategy. We hope you enjoy it!

The Merger

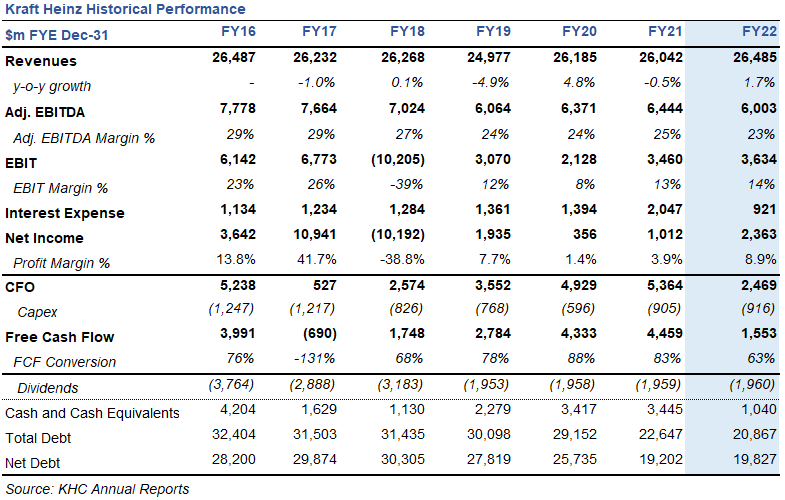

The Kraft Heinz Company was formed in 2015 through the merger between Kraft Foods Group and H.J. Heinz Company. This merger was possible thanks to the collaboration between 3G Capital, a Brazilian-American multibillion-dollar investment firm, and Berkshire Hathaway, the investment conglomerate led by Warren Buffet. The merger put in place a sizeable company with combined revenues of over $26 billion, however, the newly formed company would also have to start operations with a mountain of debt exceeding the $30 billion mark. As a result of the highly leveraged position, KHC had to pay interest payments on a yearly basis of $1.1 billion. Further to this, after the completion of the merger, an aggressive shareholder returns policy was put in place with the company set to pay annual dividends of approx. $3 billion.

The company was able to support these conditions for a couple of years thanks to its robust free cash flow generation which was enabled by its economies of scale and efficiency. Nonetheless, this situation was unsustainable, the company was not able to keep up with the debt burden and aggressive shareholder returns policy. For reference, in the table above it is evident that the free cash flow generated by the company was not sufficient to cover the extravagant dividend payments management had put in place. In the end, it all came crashing down, throwing the company into a spiral of problems that would hinder the company's growth for about half a decade.

Kraft Heinz Downfall

The unsustainable debt levels and aggressive shareholder returns policy left the company in a weak position to sustain any type of challenge. Unfortunately for KHC and its investors, the challenges the company encountered triggered a substantial decline in the company's financial performance which impacted many investors. It all started when the company announced it had suffered significant asset writedowns which put a $15 billion dent in the company's balance sheet. Further to this announcement, management also cut dividends by 36% as the aggressive shareholder returns policy in place was simply unsustainable. The asset writedowns and dividend cuts would force the company's main shareholders, 3G Capital and Berkshire Hathaway to look for a management change and to start the process of selling valuable assets in order to reduce the high debt position.

In the midst of a management change, it was now time for the rating agencies to take a deeper look into KHC. When the rating agencies took a deeper look into the company's problems, they would create even more pressure by downgrading its debt from the lowest investment grade (BBB-) to below investment grade (BB+). As investors know, a credit rating is a score representing how trustworthy a company is in paying back its debt. A lower credit rating means there is a higher risk that the company will repay its debts and as such the interest charged on the company's debt will increase. This is exactly what happened to KHC and eventually, its interest expense increased from $1.1 billion to $1.4 billion.

The combination of these headwinds would send KHC's stock price to $25, representing a collapse of 76% from its all-time highs.

The Restructuring Process

In 2019, the company started a restructuring process in which it made changes to its management team. The most important changes were the appointment of CEO Miguel Patricio and the comeback of the experienced CFO, Paulo Basilio. Patricio was already considered a wizard when it came to marketing, with vast experience from various roles at the brewing giant Anheuser-Busch InBev SA. From the start, Patricio looked to reinvigorate the underinvested brands at KHC. Patricio was quick to reshape the company by transitioning from 55 individual categories to six consumer-driven platforms, while at the same time investing in marketing and the company's brands.

On the other hand, Basilio focused on cost controls and the reduction of debt, which he achieved in an impressive manner. Shortly after the management changes, in 2020 KHC announced the sale of two major business units. The company agreed to sell its natural cheese business to Groupe Lactalis for a purchase price of $3.2 billion. This unit accounted for roughly $1.8 billion in sales and approximately $265 million in adjusted EBITDA. KHC also agreed to sell its nuts business (including Planters), to Hormel Foods (HRL) for $3.4 billion. The nuts business contributed approximately $1.1 billion in sales per year to KHC.

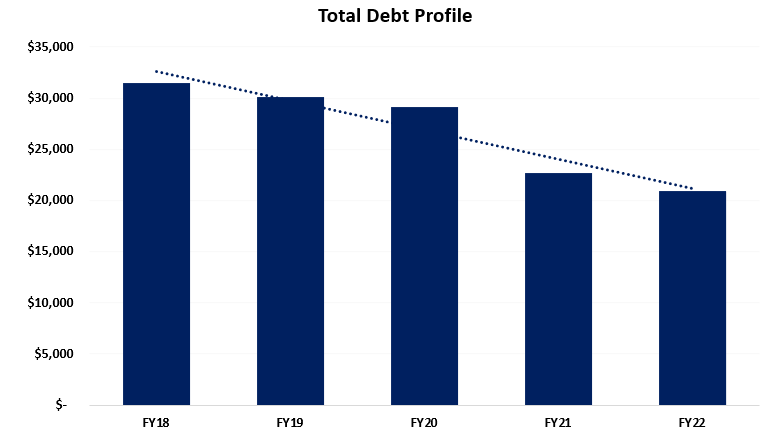

The sale of these business units helped KHC reduce its debt position by about $6 billion. However, the loss of revenues would be substantial with both units accounting for a combined amount of $2.9 billion. During this time, KHC also used its robust free cash flow to pay back as much of its debt as possible. These actions resulted in the reduction of debt from $29.2 billion at the end of 2020 to the current debt level of $20.9 billion at the end of 2022.

KHC's improved financial position led to the credit rating upgrade to investment grade in May 2022. The upgrade came as a result of better cost controls and prudent balance sheet management. In addition, as a result of the significant decrease in debt levels, KHC paid substantially lower interest payments during 2022 compared to the amounts paid during the last three years. Six months after achieving an investment grade rating, the rating agencies would again upgrade KHC's status to a BBB rating. This time, the better rating was deemed as a result of good operational performance with the company being able to sustain its revenue levels despite substantial asset sales.

A Closer Look at Kraft Heinz Deleveraging

Since 2018 KHC has paid down about $11 billion in debt. This has allowed the company to achieve a current net leverage position of 3.3x compared to 4.59x at the end of 2019. Please note that we are using a net leverage formula of Adjusted EBITDA to Net Debt.

It should be noted that the Adjusted EBITDA has also decreased by almost $1 billion since 2018, this decrease is a result of the different divestments done by the company during the past years. Most notably the previously mentioned divestments to Groupe Lactalis and Hormel. However, when comparing this decrease to the reduction in debt, one could say this was a reasonable price to pay in order to deleverage the company and attain a healthier financial position.

Management has been vocal that it wants to reduce the net leverage even further to 3.0x, which it will try to do by paying down debt opportunistically.

Building a Comfortable Debt Maturity Profile

Management has been able to spread out the bond repayments over a number of years. Something truly impressive to highlight here is the fact that management has spread out the company's maturity profile in order for KHC to repay about 75% of its debt after 2027. At the moment KHC enjoys interest rates 100% fixed with a debt-weighted average maturity of 14.5 years and its leverage meaningfully improved. This provides KHC with a strong balance sheet and sufficient financial flexibility to pursue strategic acquisitions, a share buyback program, or increase dividends.

From the table below it can be seen that KHC only needs to repay $1.4 billion of debt during the next three years. This gives the company the opportunity to repay the debt and not roll on it. Why is this important? Well, due to the increasing interest rate environment, if KHC would roll on its debt it would need to refinance it and pay a higher rate on it. This is a problem many companies will face in the coming years. Fortunately for KHC, it is able to wait for better times to refinance its debt. Due to the low amounts of debt, it needs to pay back in the coming years, the company can simply keep paying back its debt with its robust free cash flow generation.

Kraft Heinz Financials Post-Restructuring

As has been discussed in the article, KHC has experienced many challenges since its merger. From the table above this can also be seen in the company's revenues, as the company has not been able to pass over the $26 billion mark for more than half a decade. Saying this, it should be mentioned that KHC was able to retain its top-line levels despite its recent business divestments (the nuts business unit and the natural cheese business unit) which accounted for about $2.9 billion in yearly revenues. KHC performed well during the last few quarters, offsetting most of this decrease in revenues through an increase in pricing and robust performance on its product categories, condiments, and refreshments. These product categories have increased revenues by ~$1.2 billion and ~$350 million during the last three years.

The next item to highlight is the substantial decrease in interest expenses paid by the company during 2022. For reference, KHC paid interest expenses of $2 billion in 2021 in comparison to $921 million in 2022. This decrease has resulted in interest expenses only representing 39% of the company’s net income. Important to note that during the previous 3 years, interest expenses had depressed the company’s net income significantly.

This improvement comes as a result of the reduced debt levels, with total debt currently standing at $20.9 billion compared to $29.2 billion just two years ago. Thanks to this improvement, the company will be able to keep this cash and enhance its bottom line. Please note that KHC's profits were depressed by goodwill and intangible impairments (non-cash charges) amounting to $913 million in 2022 representing a net income margin of 8.9%. As can be seen in the graph below, this is a nice improvement compared to the previous 2 years.

The company did see its cash flow from operations decreased to $2.5 billion in 2022. This decrease compared to the 2021 results was due to a surge in inventory levels which caused a cash outflow of $1 billion. It should be noted that many companies faced similar scenarios with their inventories as a result of the inventory glut caused by the Covid-19 pandemic. After 2022, it is highly possible that management will solve the inventory issues and that goodwill impairment will no longer be present in the company's financials. Should things normalize we could see both net profits and cash flow from operations enhanced during 2023.

It is also important to note that during the previous year, KHC made some divestments from which it received proceeds from sales of licenses of $1.6 billion. As such in combination with the inventory glut, both the company’s cash flow from operations and its free cash flow decreased compared to the previous years. Furthermore, the free cash flow conversion decreased to 63%, the lowest in four years.

The company used its free cash flow for the year in combination with its cash to pay dividends of $2 billion, repay long-term debt amounting to $1.5 billion and pay for acquisitions totaling $481 million. Important to note that the company has not done any share buybacks during the last 3 years.

Current Strategy and Growth Initiatives

Kraft Heinz currently owns six brands with over $1 billion in revenues which include: Kraft, Heinz, Lunchables, Velveeta, Oscar Mayer, and Philadelphia. Further to this, management is looking to accelerate profitable growth through the addition of new brands. For a few years, KHC was stagnant when it came to inorganic growth, however, this has changed in the past two years as management started acquiring companies and expanding its international footprint.

In the past two years, KHC acquired companies in different regions of the world including Brazil, Turkey, and Germany. These are welcomed news by investors, and we can expect that management will keep looking for inorganic growth opportunities. The acquired companies include Assan Foods, a Turkish condiments company. Hemmer, is a Brazilian condiments and sauces company. Just Spices, is a German supplier of numerous spice blends and pure spices. These acquisitions come on the back of the realization that the emerging market taste elevation industry is worth about $60 billion in yearly retail sales. As such with a local presence in over 32 countries management will try to increase its market share through the acquisition of well-known brands.

Thanks to the healthier financial position and strong management team, KHC is now able to set long-term growth goals which will see the company enhance the top and bottom lines. Management has set the following long-term goals:

Organic net sales growth of 2% to 3%. It should be mentioned here that inorganic growth will probably bring the growth rate into the mid to high single digits.

Adjusted EBITDA growth of 4% to 6% through the expansion of Gross Profit Margin and investment for growth fully funded by the increase in Gross Profit Margin.

Free Cash Flow conversion of 100% is driven by the reduction of interest expenses and the better management of working capital.

Conclusion

Since its merger, KHC has been battered by various problems which have been covered extensively in this article. However, the company's management team has taken the necessary steps to restructure the company. As a result of these restructuring efforts, KHC had to sell valuable assets which helped the company pay down about $11 billion in debt and helped it decrease its interest expense burden.

As we have demonstrated throughout this article, KHC has gone through a truly difficult situation to what some people could consider a blue chip stock. Investors are no longer at risk of losing their dividends, the stock price has stabilized and the company is finally looking for growth opportunities. KHC is indeed turning a corner and is now a company with solid fundamentals and a great management team. This combination makes the prospects of the company very attractive. Investors should also realize that at current prices KHC offers a nice dividend yield of about 4%, as well as the opportunity for share price upside driven by an increase in profits and financial stability.

Disclaimer: The information provided in this article is for informational and educational purposes only and should not be construed as financial or investment advice. The content of this article is based on the authors' personal opinion and research, and it may not be appropriate for your specific investment goals, financial situation, or risk tolerance. Any investment decision you make should be based on your own research and analysis, and you should consult with a qualified financial advisor before making any investment decisions. The author of this article assumes no responsibility or liability for any investment losses or damages that may result from your reliance on the information provided herein.