Vita Coco: Pioneering the Coconut Water Revolution

At DG Investment Research we will start analyzing more companies with small and medium market capitalizations. The first company we will analyze is Vita Coco a company with a market capitalization of $1.6 billion, as such considered a small-cap company. It is important to note that while small-cap companies can offer significant growth potential, they also come with a unique set of risks. Due to their size, they may have limited resources, making them more vulnerable to economic downturns and competitive pressures. Their stocks can be more volatile, with share prices subject to sharp fluctuations. Additionally, small-cap companies might not be as widely covered by analysts, leading to less transparency and information available to investors. With this, we hope you like enjoy the article!

Summary

Vita Coco has pioneered the packaged coconut water industry, achieving a dominant market share of 50% in the U.S. and 82% in the U.K.

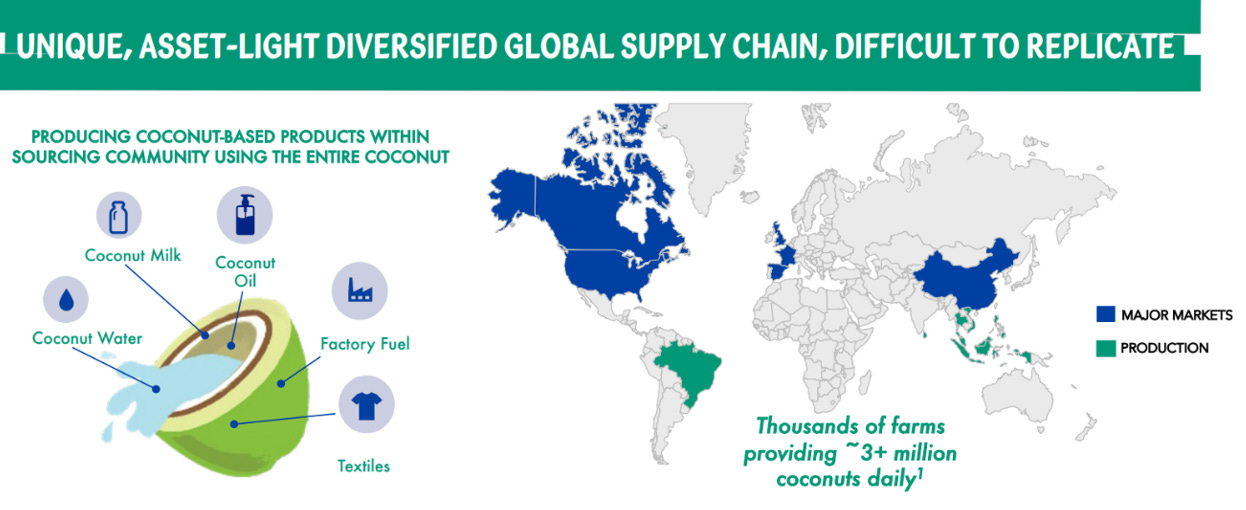

Vita Coco operates with an asset-light model, sourcing coconut water from 14 factories across six countries.

The company has expanded its supply chain globally, partnering with major coconut producers.

Despite competition from giants like Coca-Cola and PepsiCo, Vita Coco has maintained its market leadership.

Since its foundation in 2004, Vita Coco (“COCO”)has been a serious contender in the coconut water industry, pioneering the introduction of packaged coconut water. Over the years, the company has not only expanded its product offerings but has also made significant strides in market penetration, supply chain management, and brand innovation. Vita Coca is nowadays the biggest pure-play coconut water company in the world with an estimated 50% market share in the U.S., 82% in the United Kingdom, and a significant presence in 30 countries. Let’s take a look at how the company has evolved through growth and innovation since its founding.

A Timeline of Growth and Innovation

2004 - Vita Coco introduced packaged coconut water in the US.

2016 - The company ventured into the private-label coconut water segment, strengthening ties with strategic retail partners.

2018 - Vita Coco acquired the plant-based energy brand, Runa, further diversifying its product portfolio.

2021 - The company launched PWR LIFT in select markets, targeting post-workout and recovery hydration.

2022 - Vita Coco is estimated to have captured approximately 50% of the U.S. market share.

2023 - The company is set to nationally distribute its collaboration with Diageo, Vita Coco Spiked with Captain Morgan.

An Asset-Light Business Model with Global Reach

Vita Coco's business model is characterized by its asset-light structure. The company sources its coconut water from a diversified network of 14 factories across six countries, supported by thousands of coconut farmers. This approach allows Vita Coco to swiftly adapt to market changes and consumer preferences. Furthermore, the company collaborates with co-packers in America and Europe, ensuring local packaging and repacking to meet customer needs.

Today, Vita Coco products touch the shelves in over 30 countries, with North America, the United Kingdom, and China being primary markets. The brand's presence is felt across various distribution channels, from clubs, food outlets, and e-commerce platforms to on-premises locations like corporate offices and fitness clubs.

A Sustainable Supply Chain

As demand has grown, so has the need for coconuts. Vita Coco expanded its supply chain from Brazil to Southeast Asia, partnering with major coconut producers. These producers, who once discarded coconut water as a by-product, have now realized its potential. Vita Coco's unique approach to upcycling, even before it became a buzzword, ensured a robust and globally diversified supply chain. This asset-light model, combined with direct access to coconut farmers and partnerships with processors worldwide, has given Vita Coco a competitive edge that's hard to replicate.

Understanding the Consumer

Vita Coco's marketing strategies have evolved with a deeper understanding of its core consumer base. Initially targeting health-conscious individuals and yoga enthusiasts, the company soon realized that its primary audience was younger, urban, and multicultural. This insight led to campaigns targeting specific occasions, such as hangovers post-Super Bowl or New Year's celebrations.

Consumer Insights

The brand resonates with multicultural and younger consumers.

Over-index to Asian or Hispanic consumers, Generation Z, Millennials, and families.

Attraction of new shoppers and high-value shopper baskets.

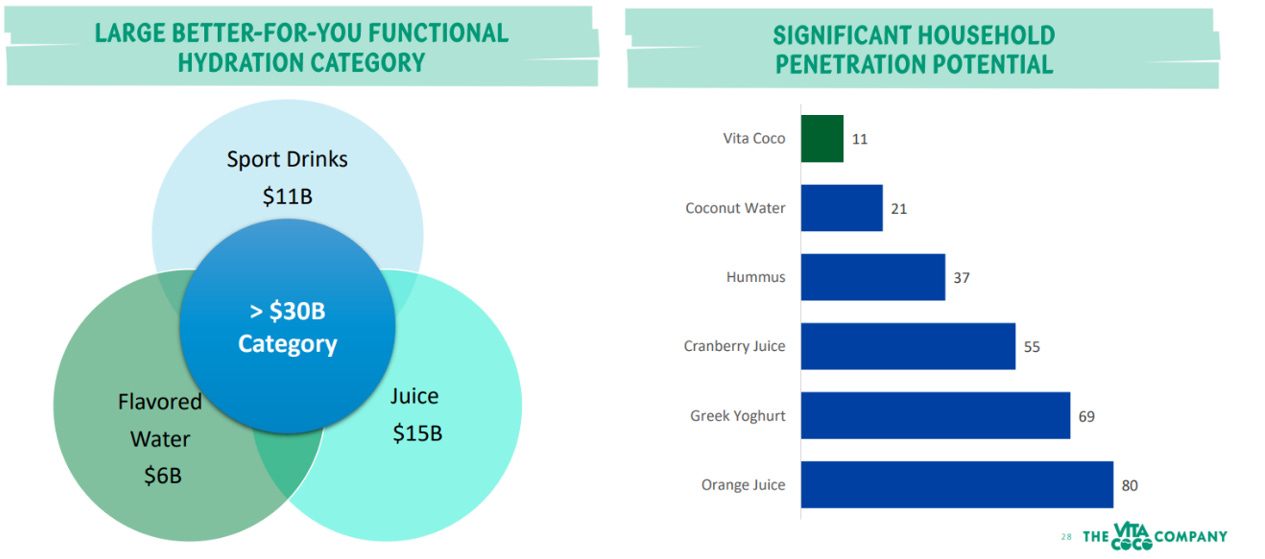

US Beverage Industry Size and Opportunity

Vita Coco's portfolio is diverse. While it leads with its flagship coconut water, it also includes Runa, a plant-based energy drink, and Ever & Ever, a sustainably packaged water. This diverse offering allows them to tap into a U.S. beverage market worth over $119 billion. With its diverse product range, the company is able to tap into the Sports Drink market worth $11 billion, the Juice market worth $11 billion and the Flavored Water market worth $6 billion. The combination of these 3 markets gives Vita Coco a participation in markets worth about $30 billion.

Further to this, Vita Coca is the leader in the US Coconut Water market worth about $1 billion and expected to grow at a rate of 11.71% from 2022 to 2029. Vita Coco is poised to benefit significantly from this growth. Moreover, with major players like Coca-Cola and PepsiCo scaling back their presence in the coconut water space, Vita Coco has cleared itself from competition, allowing for potential increased profitability.

Facing the Giants

The beverage industry is fiercely competitive, with giants like Coca-Cola, PepsiCo, and Nestlé dominating the scene. However, Vita Coco has managed to carve a niche for itself, especially in the coconut water segment. Despite the challenges posed by major competitors and emerging brands, Vita Coco's market leadership in the U.S. and the U.K. is a testament to its quality and brand loyalty.

The journey wasn't without its challenges. When giants like Coca-Cola and PepsiCo entered the coconut water arena in 2009, many predicted the end for independent brands like Vita Coco. But with a combination of innovation, determination, and a product that consumers adored, Vita Coco not only survived but thrived, emerging victorious from what industry insiders termed "The Coconut Water Wars." Let’s now take a look at the financial since its IPO.

Financial Highlights

Since 2019 Vita Coco has increased its revenues by 50% from $284 million to $428 million at the end of 2022. On a year-on-year basis, Vita Coco increased its revenues by 12.6% from $380 million in 2021 to $428 million in 2022. This increase has been driven by the company’s penetration into the coconut water market as well as strategic decisions that have seen the company venture into for example private-label coconut water. The Private Label offering has enhanced the efficiency of Vita Coco's coconut water supply chain, contributing positively to the company's bottom line. Further to this, the company has also entered different product categories such as post-workout recovery hydration and alcoholic beverages.

Vita Coco margins have seen a decline since 2020, mainly as a result of the Covid-19 pandemic which increased shipping and handling costs. As the company is still small in size (market cap of $1.6 billion) these expenses have been hard to offset with price increases. Despite these challenges, Vita Coca has been able to remain profitable every year since 2019. During 2022 the company recorded an operating profit of $10.4 million and a net income of $7.8 million.

As a result of the deterioration in its margin profile and struggles with working capital, the company has recorded a negative operating cash flow during the previous two years.

Let’s take a look at the company’s cash flow profile when it is able to generate a positive cash flow from operations, as it did during 2019 and 2020. Thanks to its asset-light business model the company is able to retain most of its cash flow from operations. This is thanks to the fact that Vita Coca sources its coconut water from a diversified network of 14 factories, however, the company does not own the factories. As such little investment is necessary to keep the company running on all cylinders. This allows the company to produce free cash flow conversions above 95%.

On a final note, the company has a strong liquidity profile with essentially no debt and a net cash position of $16.8 million.

Global Footprint

Vita Coco's role in popularizing coconut water is unparalleled. Holding approx. 50% market share in the U.S. and a staggering 82% in the United Kingdom. This dominance isn't limited to just these regions. Globally, Vita Coco is available in more than 30 countries, with primary markets in North America, the UK, and China. Furthermore, their strategic targeting of younger, multicultural consumers positions them advantageously for the future. This demographic's increasing sway over popular culture suggests that Vita Coco's influence will most likely continue to grow.

Innovating for the Future

Vita Coco's success can be attributed to its continuous innovation. The company has been exploring opportunities to increase coconut water consumption occasions. Recent endeavors include the launch of new flavor variants, a barista milk product in collaboration with the LA-based Alfred Coffee chain, and a canned cocktail line in partnership with Diageo. The company also recognizes the potential of plant milks and ready-to-drink cocktails, aligning its product development strategies with emerging consumer trends.

Vita Coco continues to innovate. Their recent launch, Vita Coco Pressed, offers a richer coconut flavor and already accounts for 7% of the coconut water category. They've also ventured into the plant-based dairy alternatives segment with Vita Coco Milk. Another addition is Vita Coco Boosted, a blend of coconut MCT oil, B vitamins, and tea extract.

Diversification

While Vita Coco remains synonymous with coconut water, the company has been proactive in diversifying its product portfolio. Recent developments include the launch of PWR LIFT, a protein-infused sports drink, and a licensing collaboration with Diageo for Vita Coco Spiked with Captain Morgan, set to be distributed nationally in 2023. The company has also ventured into the energy drink market with Runa, a plant-based beverage.

Conclusion

Vita Coco has solidified its position as the leading brand in the coconut water industry. With its pioneering introduction of packaged coconut water, the company has consistently expanded its product range and achieved significant market penetration. Their asset-light business model, characterized by sourcing from a diversified network of factories and a sustainable supply chain, has enabled them to swiftly adapt to market dynamics and consumer preferences. This approach, combined with strategic partnerships and innovations, has allowed Vita Coco to dominate the market, especially in the U.S. and the U.K.

Financially, despite challenges such as the pandemic's impact on margins, the company has maintained profitability, showcasing its resilience and adaptability. Their continuous innovation, evident in product diversifications like Vita Coco Pressed and collaborations like Vita Coco Spiked with Captain Morgan, indicates a forward-thinking approach. In essence, Vita Coco's journey from its humble beginnings to its current global prominence is a testament to its strategic vision, adaptability, and commitment to delivering quality products to its consumers.

Disclaimer

The information provided in this article is for informational and educational purposes only and should not be construed as financial or investment advice. The content of this article is based on the authors' personal opinions and research, and it may not be appropriate for your specific investment goals, financial situation, or risk tolerance. Any investment decision you make should be based on your own research and analysis, and you should consult with a qualified financial advisor before making any investment decisions. The author of this article assumes no responsibility or liability for any investment losses or damages that may result from your reliance on the information provided herein.