Microsoft's Cloud June 2023 Performance: A Deep Dive into the Success of Cloud and Azure

The Briefing

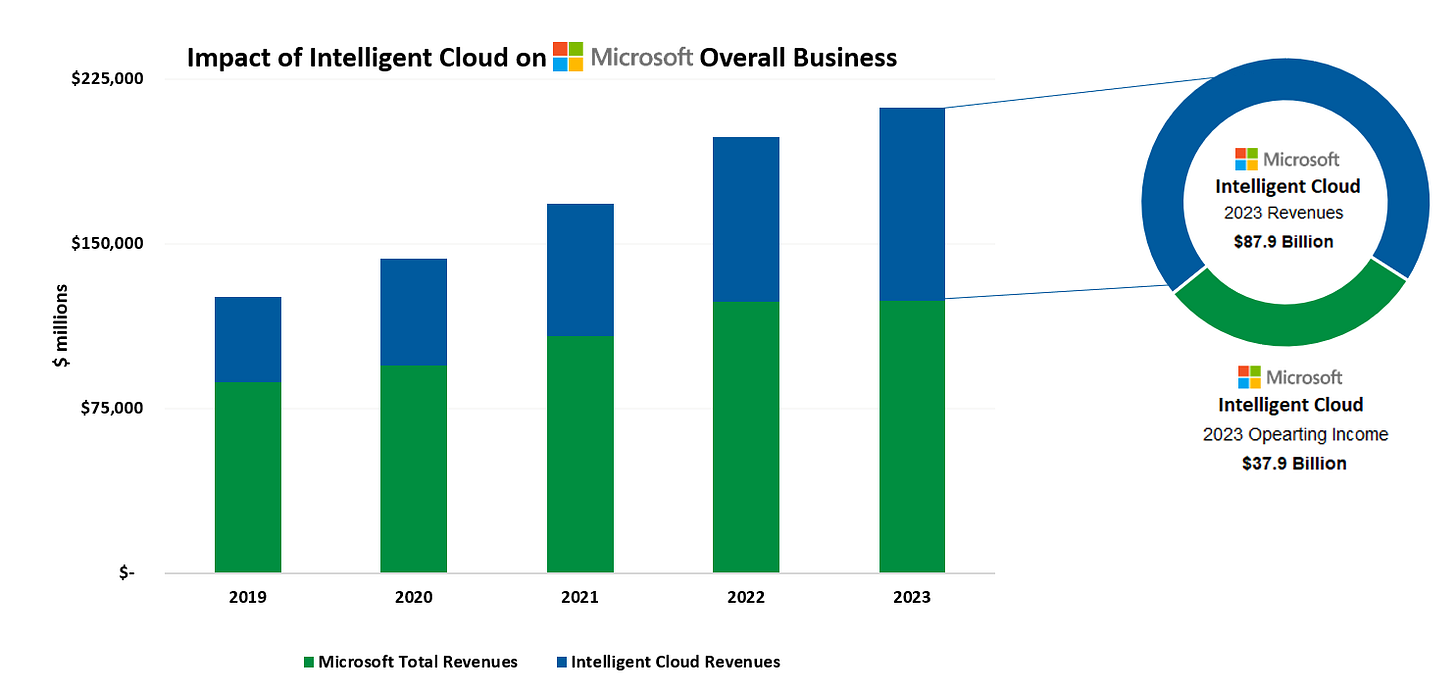

During FYE 2023, the Intelligent Cloud segment accounted for 41.5% of Microsoft’s total revenue, increasing by 17% to $87.9 billion.

The Intelligent Cloud segment also accounted for 43% of Microsoft's total operating income reaching an operating income of $37.9 billion.

It’s important to note that Microsoft does not report within one segment the total revenues derived from the cloud, however, management did say that cloud revenues surpassed the $110 billion mark during FYE 2023.

Microsoft Cloud: Soaring to New Heights

Microsoft's total cloud business has achieved a significant milestone, surpassing $110 billion in annual revenue, marking a 27% increase in constant currency. Notably, Azure, Microsoft's flagship cloud service, contributed to more than half of this total for the first time. This achievement underscores the growing importance of Azure in Microsoft's cloud portfolio and the increasing adoption of cloud services by businesses worldwide.

Microsoft Intelligent Cloud segment became the biggest cloud computing business in the world during the June quarter as the Trailing Twelve-Month revenues from Amazon's cloud business segment AWS revenues reached the $85.4 billion mark.

Microsoft is now in the lead of the highly contested cloud market, and it seems like the company will not stop its growth. It has now passed Amazon which in contrast to Microsoft, is seeing somewhat of a slowdown in its AWS segment. A distant third is Google Cloud, which saw a nice bump in its revenues and operating income during the June quarter, however, Microsoft Intelligent Cloud revenues dwarf Google Cloud revenues.

Microsoft only provides broken-down information about its intelligent cloud segment. As such we will focus on this, but it is important to remember that this is not the whole picture.

As mentioned in the briefing, the Intelligent Cloud segment now accounts for 41.5% of Microsoft’s total revenue, increasing by 17% to $87.9 billion. The segment also accounts for 43% of Microsoft's total operating income reaching an operating income of $37.9 billion. As such becomes the most important segment for the company.

Microsoft's strategy focuses on three key priorities: maximizing customer value from Microsoft Cloud, leading the AI platform shift by infusing AI across the tech stack, and driving operating leverage. These priorities reflect the company's commitment to delivering value to its customers and staying at the forefront of technological innovation.

Intelligent Cloud June 2023 Quarter Update

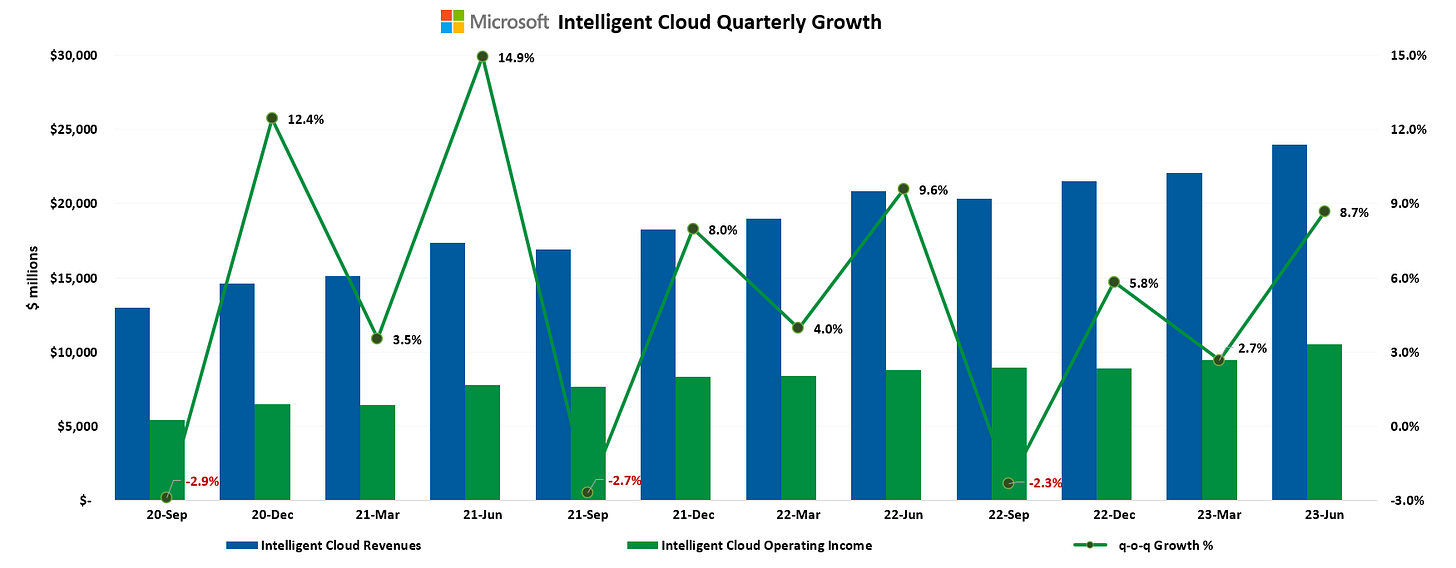

The Intelligent Cloud segment reported its biggest quarter-on-quarter increase since June 2022. In the June quarter of 2023, the segment increased its revenues on a quarter-on-quarter basis by 8.7%, reaching revenues of $24 billion. Further to this, the segment reached an important milestone reporting an operating income for the quarter of $10 billion. Important to note that this is double the quarterly operating income by AWS.

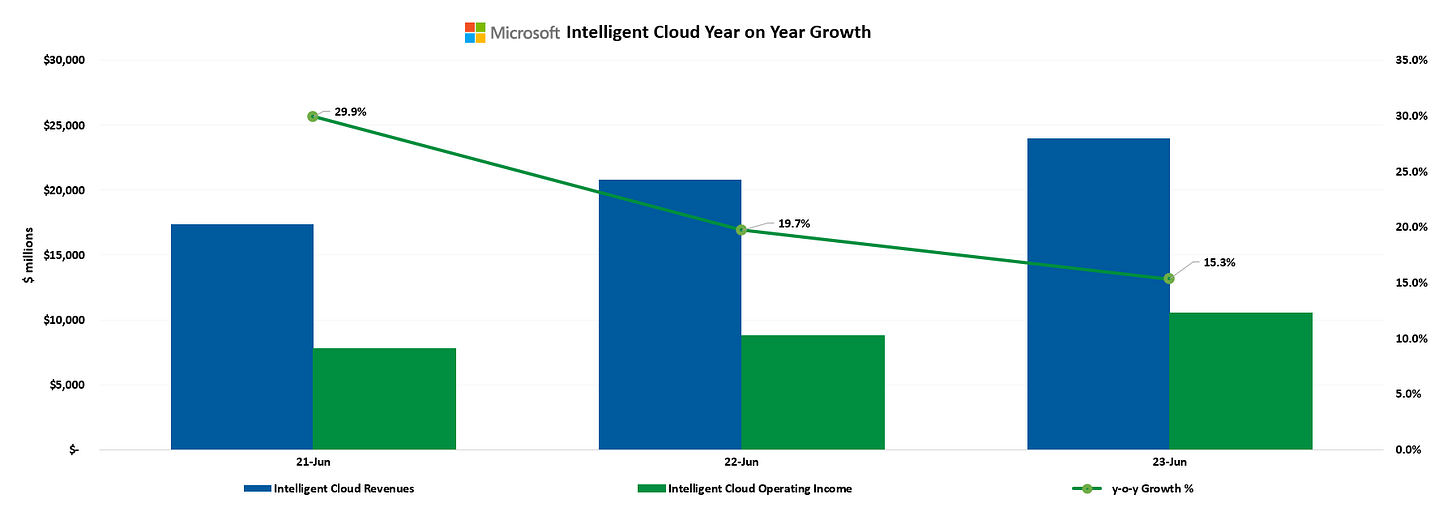

On a year-on-year basis, the Intelligent Cloud segment performed well with a revenue growth of 15.3% from $20.8 billion to $24 billion. This is a slight slowdown in revenue growth compared to the previous years, nonetheless due to the growing numbers, this is a truly spectacular performance by the segment.

Azure: The Jewel in the Cloud Crown

Azure continues to gain market share as more customers migrate their existing workloads and invest in new ones. Azure Arc, a service that simplifies complex and distributed environments across on-premises, edge, and multi-cloud, now boasts 18,000 customers, marking a 150% year-over-year increase.

Open AI is also helping Azure boost its customer pool with over 11,000 organizations across various industries using the Azure OpenAI Service, demonstrating the growing interest in AI and machine learning solutions.

Looking Ahead

Microsoft's Cloud service is not only thriving in the present but is also well-positioned for the future. The growth of Microsoft Cloud and Azure signals a strong demand for cloud services and AI solutions. As more businesses embark on digital transformation journeys, Microsoft's comprehensive and innovative cloud offerings will likely continue to drive its growth. For reference, management disclosed commercial obligations increased 19% and 18% in constant currency to $224 billion. From this massive amount, about 45% will be recognized in revenue in the next 12 months, this is an increase of 13% y-o-y. The remaining portion, which equates to a 22% increase y-o-y will be recognized beyond the next 12 months.

Conclusion

Microsoft Cloud has reached an important milestone, achieving over $110 billion in annual revenue, marking a 27% increase. Azure, Microsoft's primary cloud service, contributed over half of this total, emphasizing Azure's growing role within the company's portfolio and the global trend toward cloud service adoption. For the first time, Microsoft's Intelligent Cloud segment overtook Amazon's AWS to become the world's largest cloud computing business. Azure's market share continues to rise, with an influx of new customers migrating workloads and investing in Azure's services, including Azure Arc and Azure OpenAI. Notably, the Intelligent Cloud segment now accounts for 41.5% of Microsoft's total revenue, also contributing to 43% of the total operating income, making it the company's most crucial segment. Microsoft's cloud service shows strong prospects for future growth, backed by robust demand for cloud services, AI solutions, and ongoing digital transformations in businesses worldwide.

Disclaimer

The information provided in this article is for informational and educational purposes only and should not be construed as financial or investment advice. The content of this article is based on the authors' personal opinions and research, and it may not be appropriate for your specific investment goals, financial situation, or risk tolerance. Any investment decision you make should be based on your own research and analysis, and you should consult with a qualified financial advisor before making any investment decisions. The author of this article assumes no responsibility or liability for any investment losses or damages that may result from your reliance on the information provided herein.