China's Economic Slowdown: A Deep Dive into the Current State of Affairs

China, the world's second-largest economy, is currently grappling with a series of economic challenges. From dwindling exports to a reeling real estate sector, the nation's economic indicators are flashing warning signs. Having long been hailed as the world's factory and a significant player in international trade, China has experienced impressive growth throughout the last decades. However, like all great powers, it is not immune to challenges. Recently, the nation has been struggling with a series of economic hurdles which have resulted in scrutiny about its future growth prospects.

From a slowdown in the country’s imports and exports to a tumultuous real estate sector, the indicators suggest trouble for the Asian giant. This article aims to provide a comprehensive overview of China's current economic environment, diving into the different factors that are shaping its trajectory. Through an analysis of exports, imports, GDP growth, and other vital sectors, we will attempt to bring a holistic overview of the state of China's economy. We hope you enjoy it!

China's GDP Growth is Slowing Down

China is undoubtedly experiencing a deceleration in economic growth, driven by challenges in productivity, a shrinking labor force, and geopolitical tensions that have led to restrictions on imports. At the same time, global trading partners are exploring diversification strategies to reduce their reliance on China. Additionally, the country has experienced a real estate bubble burst, which has led to a decrease in consumer confidence. Chinese citizens are clearly bolstering their savings while at the same time being more cautious with their expenditures. These challenges have impacted the previous growth rates which had seen rates average nearly 10% in the beginning years of the 2000 era. These rates are now unlikely to return at least in the short term. However, it's an oversimplification to suggest that China has little room for growth. It should be noted that the country’s GPD per Capita is still significantly below the first world economies such as the US and the EU, giving the country’s economy vast room for growth. Let's explore the various factors impacting China's growth.

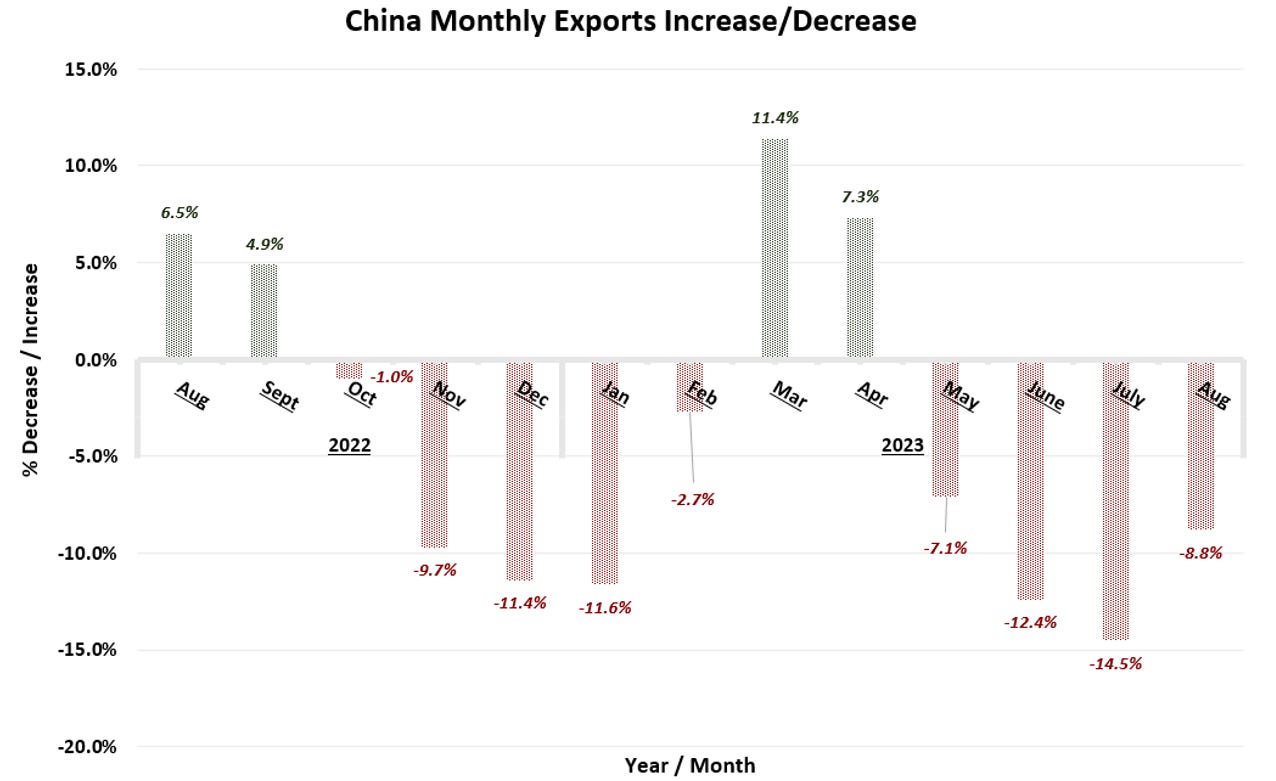

Four Straight Months with Exports Decrease

China's exports fell by 8.8% in August compared to the previous year, marking the fourth consecutive month of decline. Although this contraction was less severe than the anticipated drop, it still underscores the challenges faced by a number of sectors. It should be noted here that exports were boosted by the automotive sector which saw electric vehicles exports soaring during the January-August period.

What is causing the Export Decrease?

Several factors are contributing to the decline in exports. Western consumers are shifting their spending from goods to services, and higher borrowing rates in developed countries are impacting consumer spending. Furthermore, as ties between Beijing and the West sour, many companies are redirecting their supply chains away from China, leading to a decline in reliance on Chinese goods.

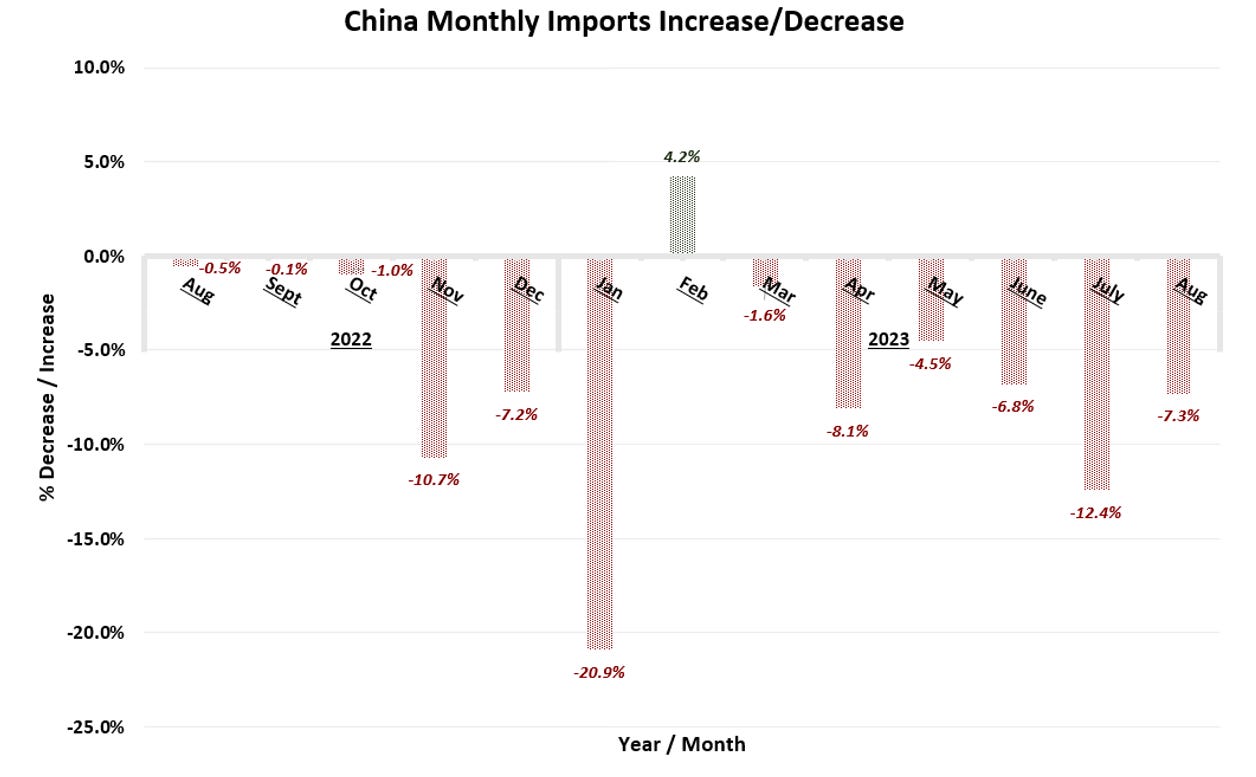

An Even Worse Performance in Imports

Imports have taken a hit as well, dropping by 7.3% in August. This decline is attributed to a lack of consumer demand within the country. Despite the nation easing its Covid-related restrictions consumers have been impacted by a downturn in the property market, a significant pillar of the Chinese economy. As a result, demand for raw materials, especially those used in construction have dwindled. It's crucial to recognize that the real estate sector intersects with numerous other sectors. Consequently, a downturn in real estate can trigger cascading effects across various industries.

A real estate bubble burst coupled with an underperforming stock market tends to have a negative impact on consumer confidence. As it will be seen later in the article households are being cautious with their expenditures and trying to save more. A normal response by citizens when economic times are challenging.

An example of how tensions with the West are impacting imports is the fact that semiconductor imports have suffered a steep decline during the year. Customs data has revealed a considerable decline in the total value of chip imports, which fell by 22.4% to reach $162 billion during the first half of 2023. Finally, it is important to note that China has seen a decline in imports in 11 of the last 12 months, which is quite impressive to see from the second-largest economy in the world.

Despite Challenges China Continues to Generate a Trade Surplus: Albeit at a Shrinking Margin

Despite the challenges in exports and imports, China managed to post a trade surplus of $68.36 billion in August. However, this figure is down by 13.2% year on year, indicating shrinking margins. China's trade surplus in August did see a month-on-month decrease, as the July figure stood at $80.6 billion.

Navigating China's Inner Landscape

China's Saving Culture: A Double-Edged Sword

Chinese households are known for their saving habits, with families saving a big percentage of their disposable income. As of 2022 this number stood at 33.5% and has not stopped increasing since 2013.

While saving has its advantages, it also means that household consumption is quite weak compared to the most advanced economies in the world. For example, the US household expenditure as a percentage of GDP stands at 68%, at a lower level but much higher than China is the EU at 51%. China saw this number increase for a few years reaching 39.2% in 2019 however once the coronavirus pandemic hit, this number plateaued eventually decreasing to 38.1% in 2021.

Government Stimulus: A Balancing Act

To counteract the economic slowdown, the Chinese government has introduced measures to make borrowing easier and cheaper. The central bank has lowered the minimum down payment for some borrowers and allowed for the renegotiation of existing mortgages. However, officials are being cautious about introducing policies that might lead to another real estate boom or weaken the yuan significantly.

Room for Growth: A Comparative Perspective

China's national income per person stands at about $12,850, which is below the threshold for a "high-income" country as per the World Bank. In comparison, Japan's per capita national income in 2022 was about $42,440, and the U.S.'s was about $76,400. As it can be seen Chinese citizens have much room for growth. As China continues to grow albeit at a slower rate it will keep closing the gap with the advanced world economies. Its citizens will become wealthier and the country as a whole will grow. Let’s take into consideration the fact that China has 1.4 billion citizens so even a small increase in national income per person can have a huge impact on the economy.

Where does China Stand? The Quarter-on-Quarter GDP Growth Remains Sluggish

China's economy expanded by 0.8% in the second quarter of 2023, in comparison to the first quarter. This sluggish growth can be attributed to the multitude of factors we have discussed during this article. It will be interesting to see if the economy will be able to hit its 5% growth rate target, we will have to wait for two more quarters to find out.

Conclusion

China, a global economic powerhouse, is currently navigating complex economic challenges. From a noticeable dip in exports and imports to a reeling real estate sector, the nation's economic trajectory has been under the microscope. Historically celebrated as the world's manufacturing hub and a pivotal player in global trade, China's recent economic indicators suggest a departure from its once-stellar growth rates. However, it's essential to understand that these challenges do not mean game over, all economies in the world go through these challenges and most of the time they come out stronger from these challenges.

The country's saving culture, while commendable, has highlighted subdued household consumption, especially when compared to advanced economies like the US and the EU. Government interventions, such as stimulus packages, are being carefully calibrated to avoid past pitfalls like the recent real estate bubble. Moreover, when viewed in comparison to other high-income nations, China's per capita national income underscores a significant potential for growth. As the nation continues its journey, albeit at a moderated pace, it remains poised to bridge the economic gap with leading economies. The next few quarters will be interesting in revealing China's resilience and adaptability in the face of these multifaceted challenges.

Disclaimer

The information provided in this article is for informational and educational purposes only and should not be construed as financial or investment advice. The content of this article is based on the authors' personal opinions and research, and it may not be appropriate for your specific investment goals, financial situation, or risk tolerance. Any investment decision you make should be based on your own research and analysis, and you should consult with a qualified financial advisor before making any investment decisions. The author of this article assumes no responsibility or liability for any investment losses or damages that may result from your reliance on the information provided herein.